At Cedar Forge Financial, We Have The Insight To…

Retire with clarity. Protect wealth. Pay less in taxes.

We specialize in retirement planning for families and individuals aged 55-75 – helping you protect your wealth, plan lasting legacies, and lower taxes - so you can retire stress-free.

Achieve The Retirement You’re Entitled To

Retire with Clarity. Protect wealth. Pay less in taxes.

At Cedar Forge Financial, we have over 20 years of experience specializing in helping retirees and pre-retirees (ages 55-75) protect their wealth, minimize taxes, and plan for lasting legacies. Transitioning into retirement comes with financial challenges, but you shouldn’t have to navigate them alone.

With trusted guidance and a tailored strategy, we help you keep more of what you’ve earned while reducing risk—so you can retire with confidence and enjoy life on your terms.

Let’s craft a retirement plan built for your peace of mind—schedule your free consultation today!

Cedar Forge Financial

Interested in attending a complimentary educational retirement planning seminar or event?

At Cedar Forge Financial, we want to equip you with the insights and resources necessary for a prosperous retirement journey. Join one of our workshops today and embark on the path to your retirement dreams.

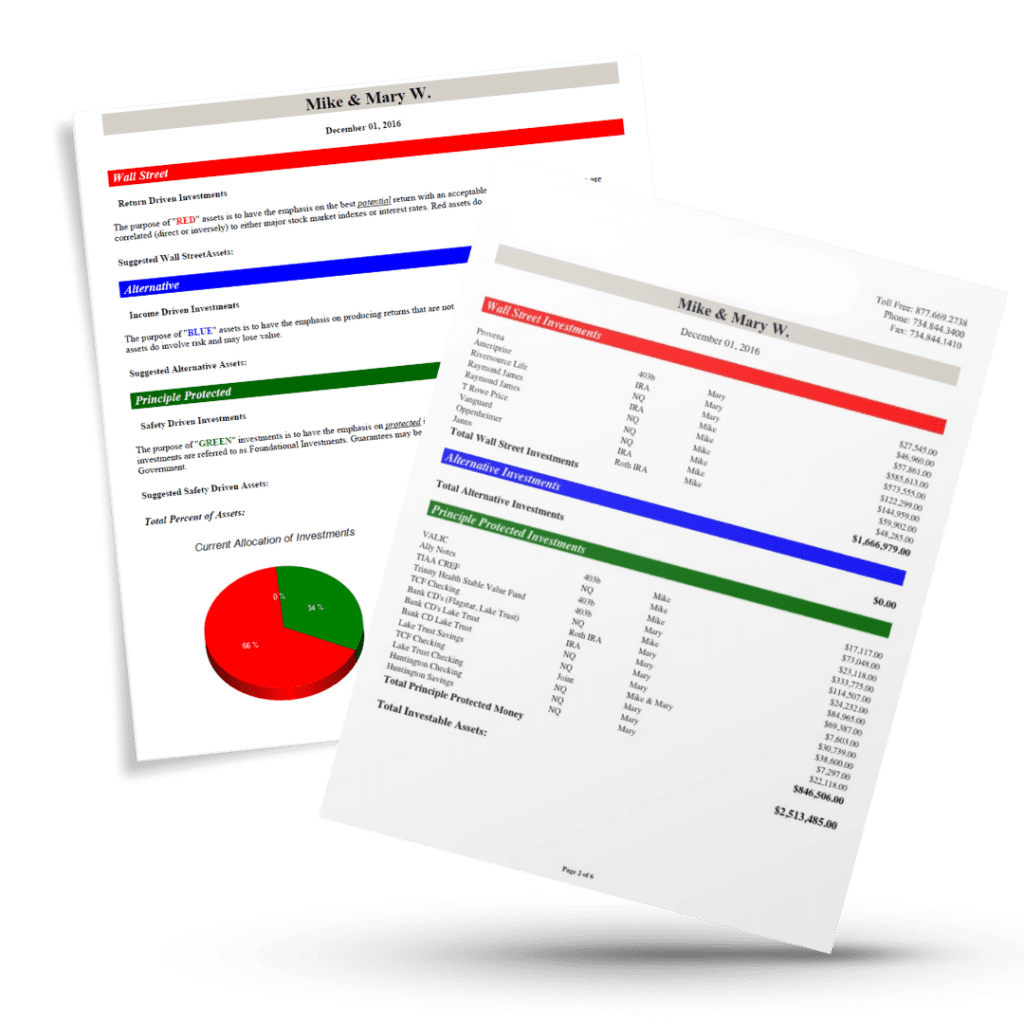

See How We Help Our Clients

We Help You Identify What Your Ideal Retirement Could Look Like

Cedar Forge Financial strives to make implementing your customized financial strategy as easy as possible. With one-on-one attention, each client is provided with the best possible plan that suits their needs. Have peace of mind and know you are cared for at Cedar Forge Financial. Our firm provides comprehensive plans tailored to our valued clients. Talk to us about the following:

Health Care Planning

We help clients prepare for future health care needs by creating strategies that balance coverage, costs, and long-term security.

how?

- Medicare supplement planning

- Long-term care insurance

- Health savings account optimization

- Healthcare cost projections

Financial Solutions

We'll assist in helping you make knowledgeable decisions and navigate the complexities of financial planning to ensure you are well-prepared for your future.

how?

- Tax Planning

- Tax Minimization Strategies

Retirement Planning

In the current landscape, retirement holds unique significance for each person. For us, it means enabling our clients to live life on their own terms, maintaining the standard of living that suits them best.

how?

- Annuity Strategies

- Pension Maximization

- Social Security Optimization

- Withdrawal Strategies

Legacy (& Estate) Planning

Establishing a well-structured plan not only facilitates the efficient transfer of your estate but also helps minimize the potential for family disputes and legal complications.

how?

- Estate planning coordination

- Trust strategies

- Charitable giving strategies

- Beneficiary optimization